Energy Market Report

Nov 5, 2024Recent Developments in Today’s Market

Bullish – Bearish statement provided by AEP Energy Trading

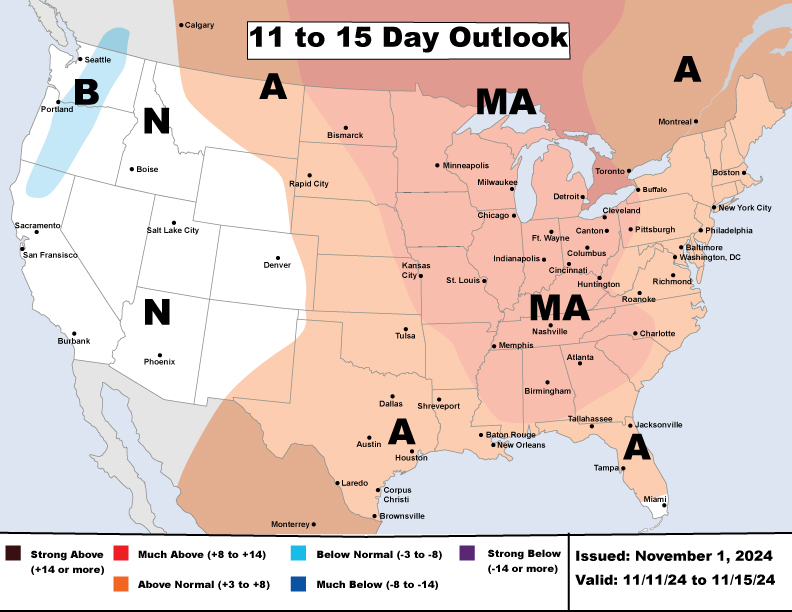

November 4th – It was a rollercoaster ride for December gas, starting the day at a low of $2.520 before climbing steadily to close up $0.116. Meanwhile, power prices for the rest of the month dipped on bearish fundamentals, but the rest of the curve followed gas upwards. The natural gas market is heating up, and with cooler temperatures on the horizon in the 11-15 day forecast, power prices got a nice little bump today.

November 1st – As we headed into the weekend, a sharp drop in spot gas prices dragged near-term power prices down. Adding to the pressure, a slew of thermal outages are wrapping up their scheduled maintenance over the next couple of weeks, which isn’t doing any favors for power prices either

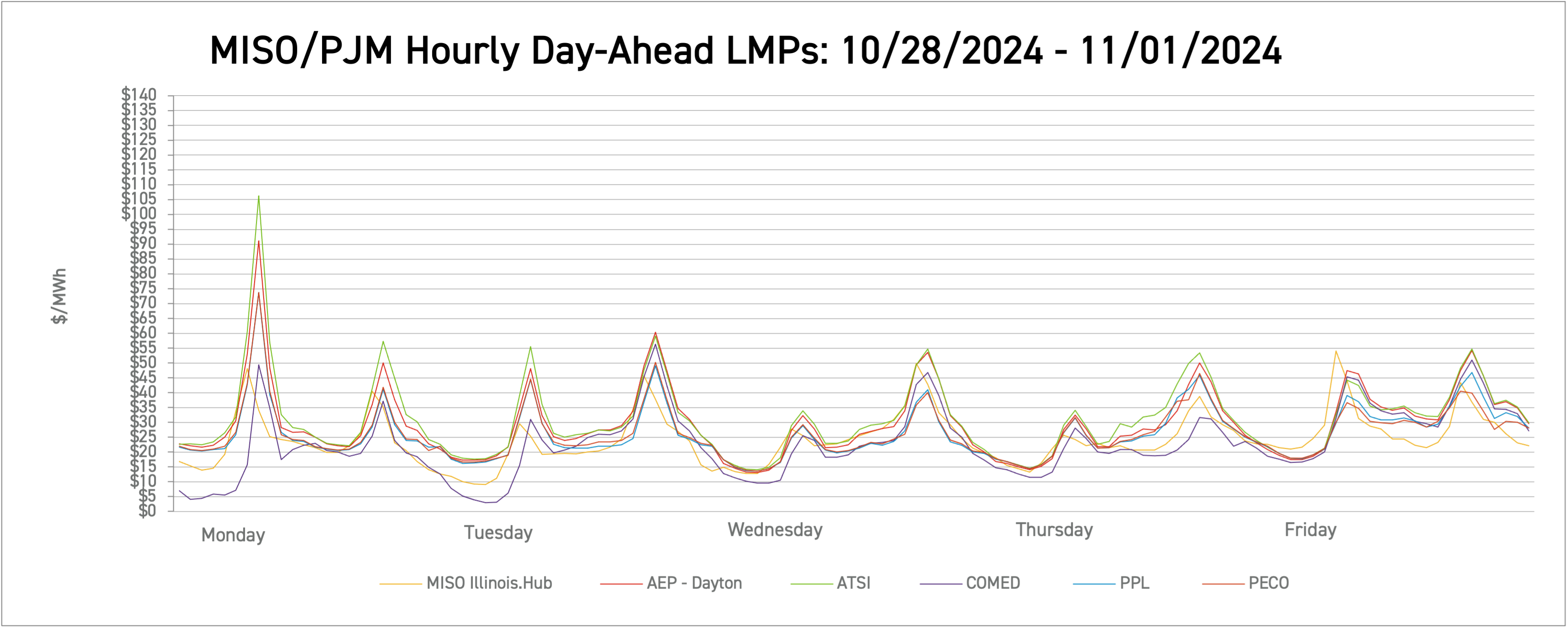

MISO/PJM Hourly Day-Ahead LMP

Source: LMP data courtesy of MISO and PJM; used with permission

*Graphs are for illustrative purposes only; LMPs priced in Central Prevailing Time (CPT)

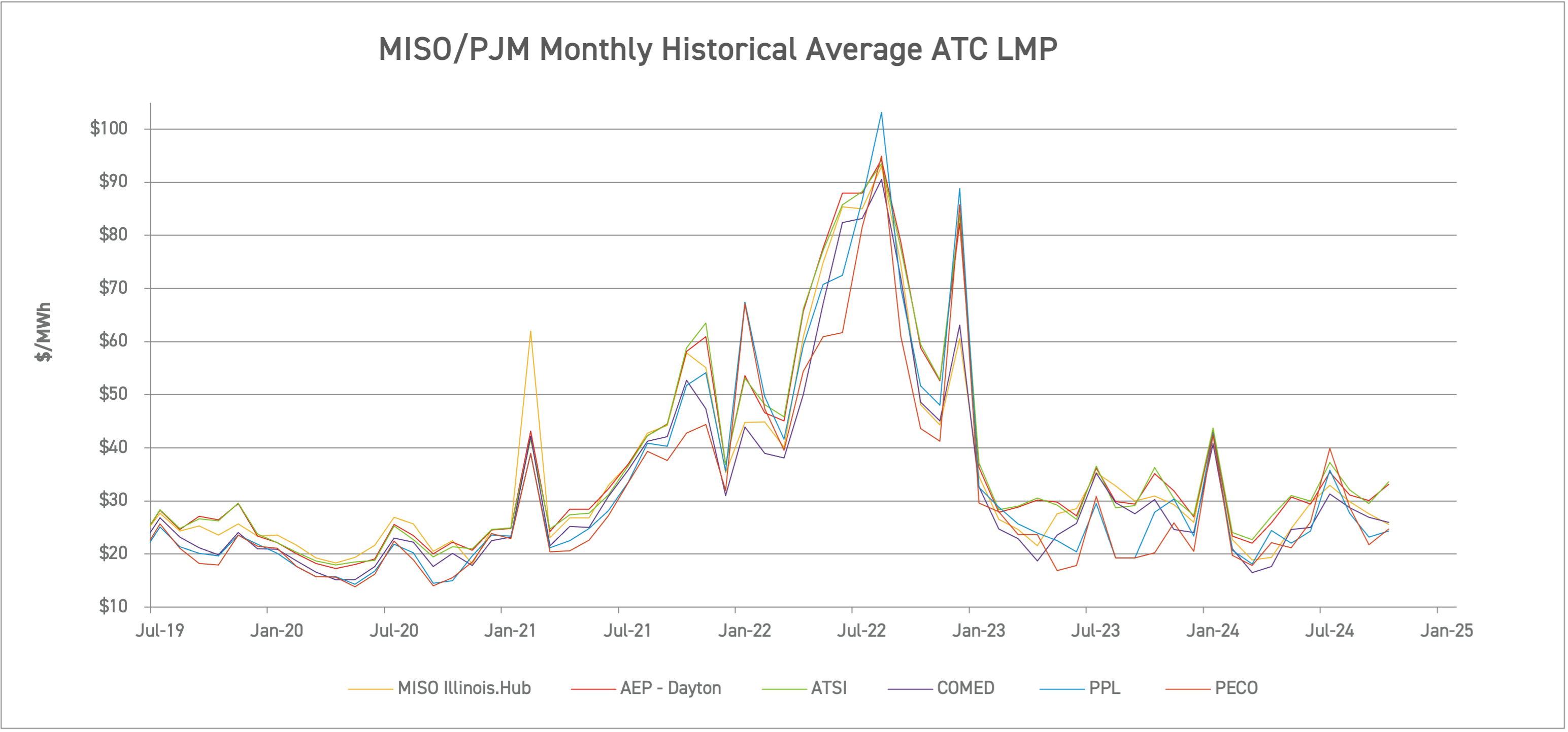

MISO/JMP Monthly Historical Around-the-Clock (ATC) LMP

Source: LMP data courtesy of MISO and PJM; used with permission

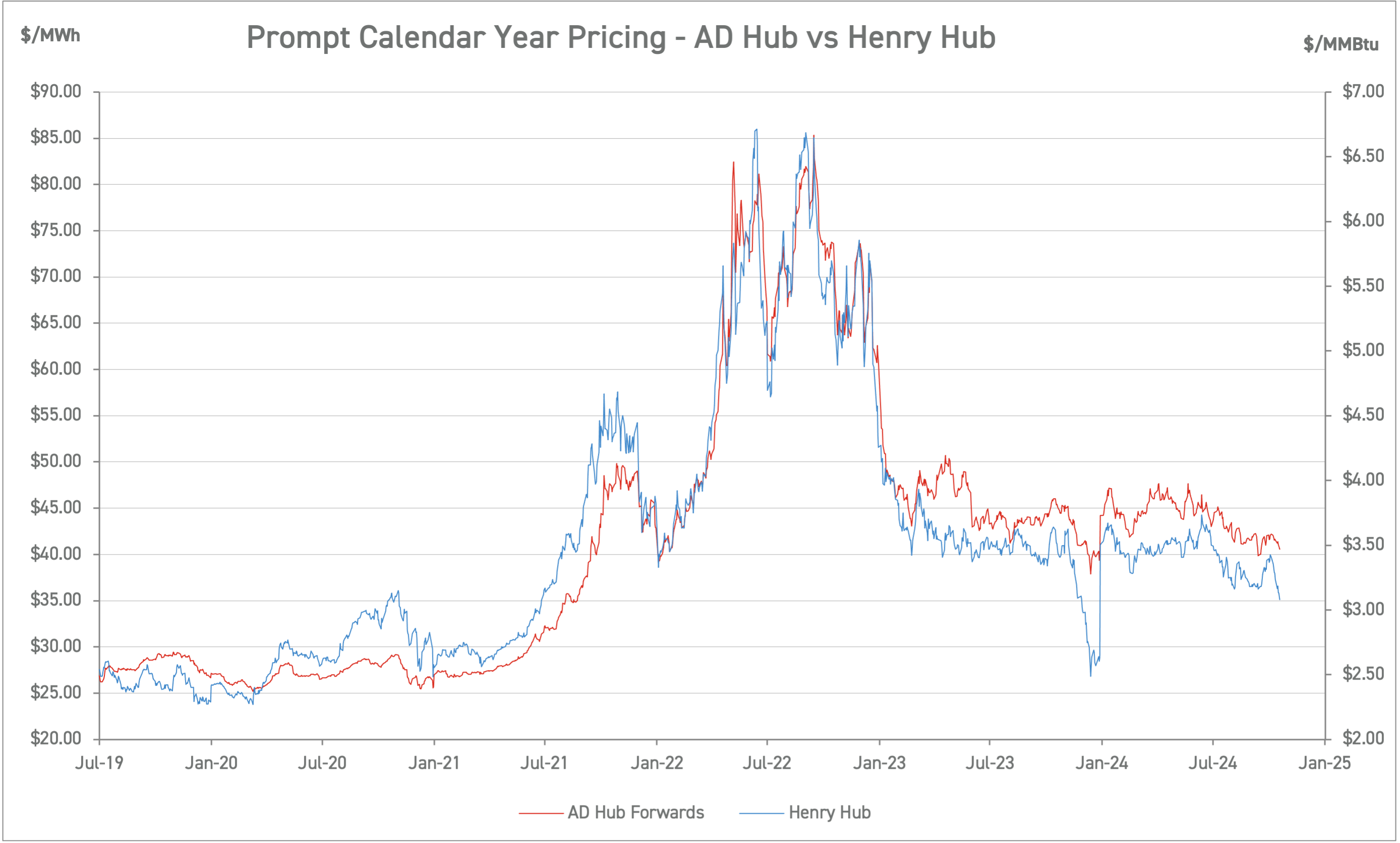

AD Hub Electricity vs. Henry Hub Natural Prices

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only; AD Hub priced in Eastern Standard Time (EST)

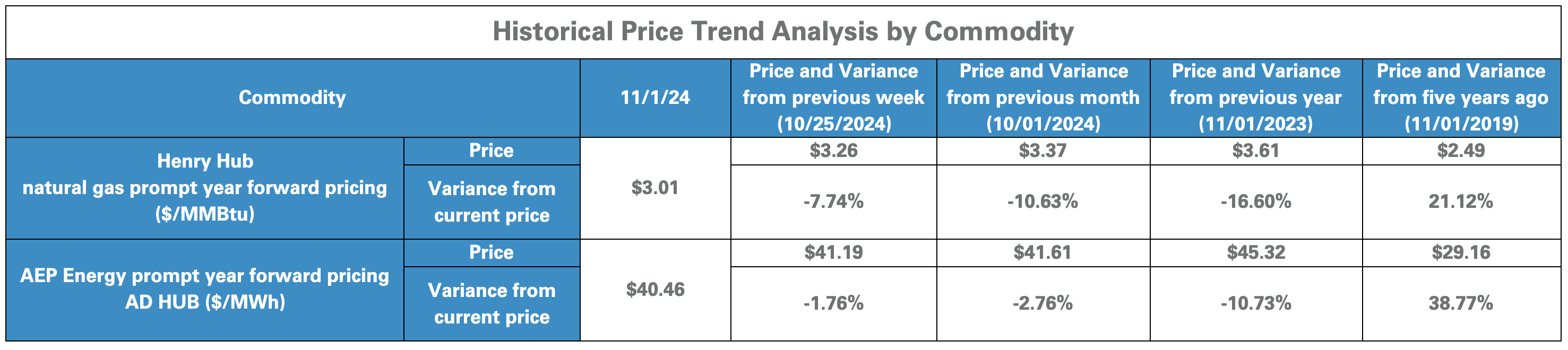

Historic Trend Analysis by Commodity

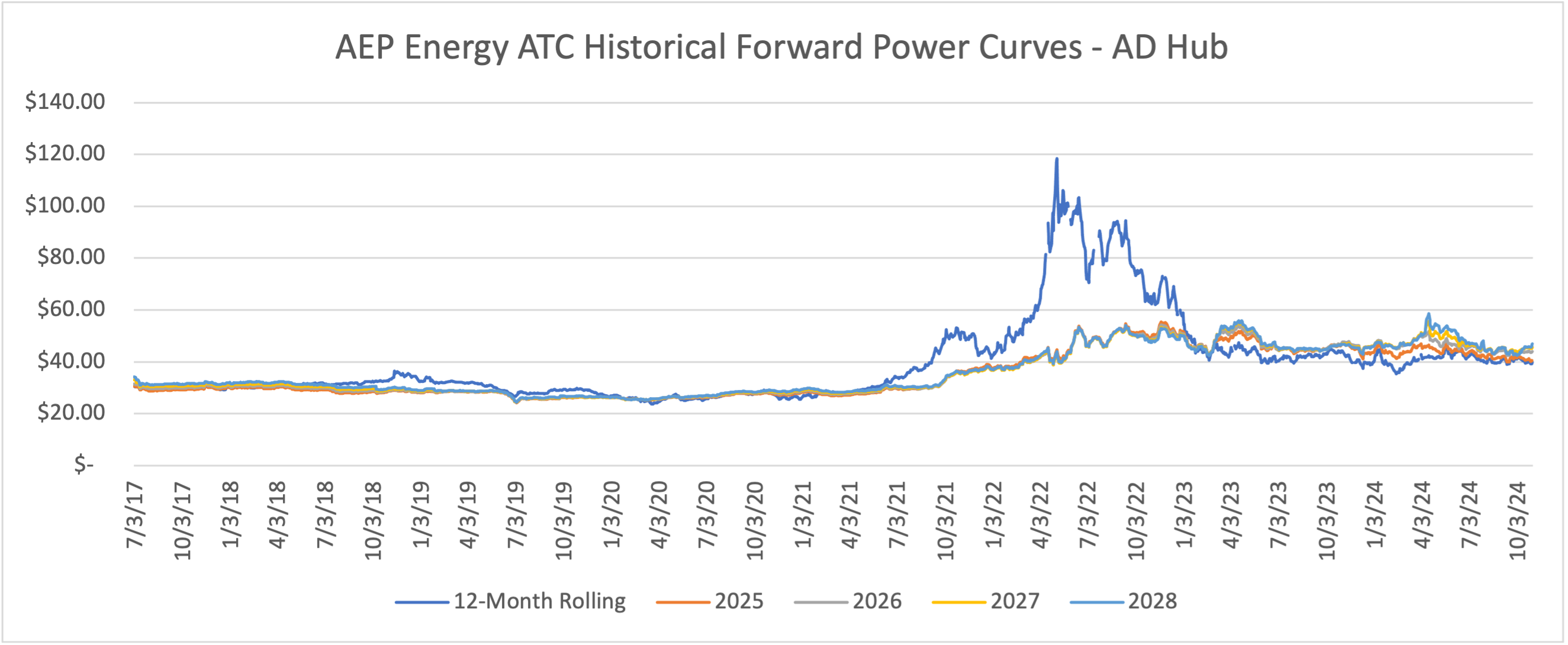

AEP – DAYTON (AD) Hub Around-the-Clock (ATC)

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. AD Hub priced in Eastern Standard Time (EST)

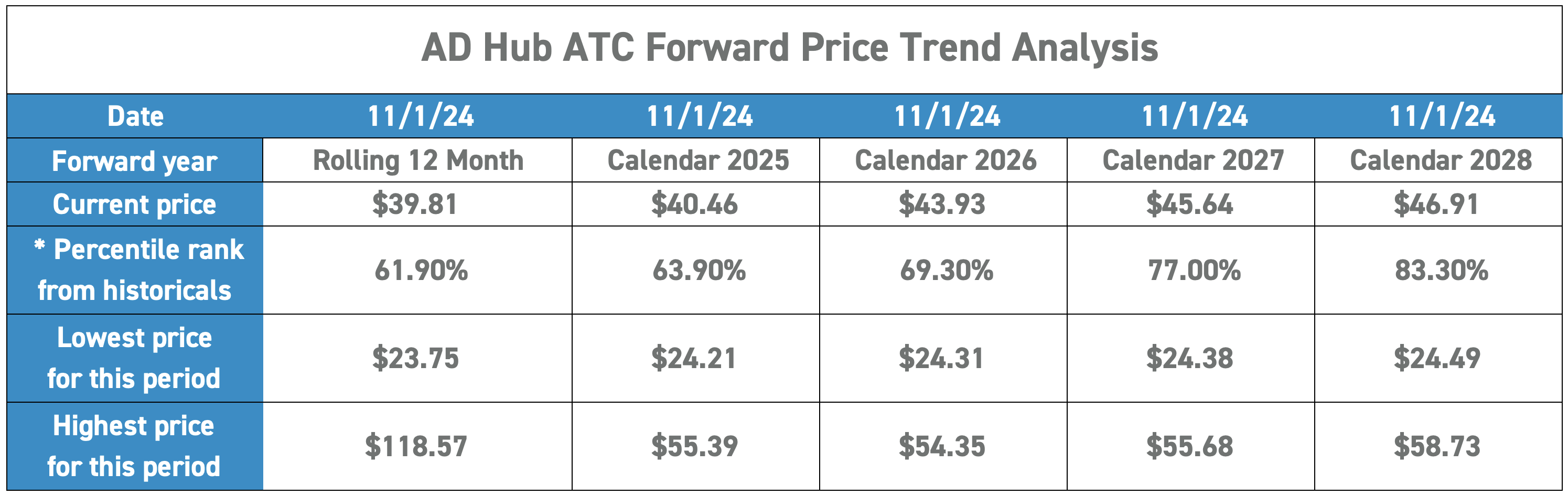

AD Hub ATC Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2026, 69.3% indicates that the current price is lower than 30.7% of historical pricing dating back to July 2017.

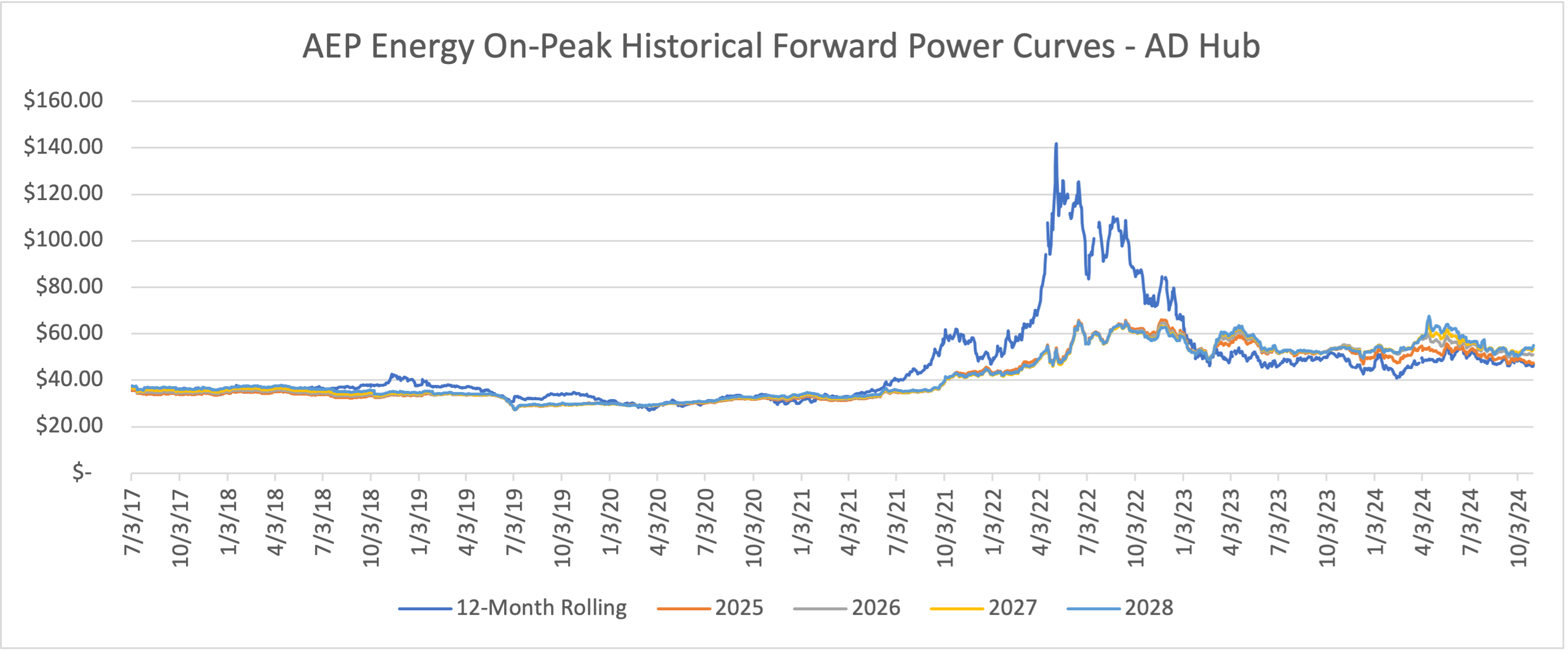

AEP – DAYTON (AD) Hub On-Peak

Source: AEP Energy internal estimates

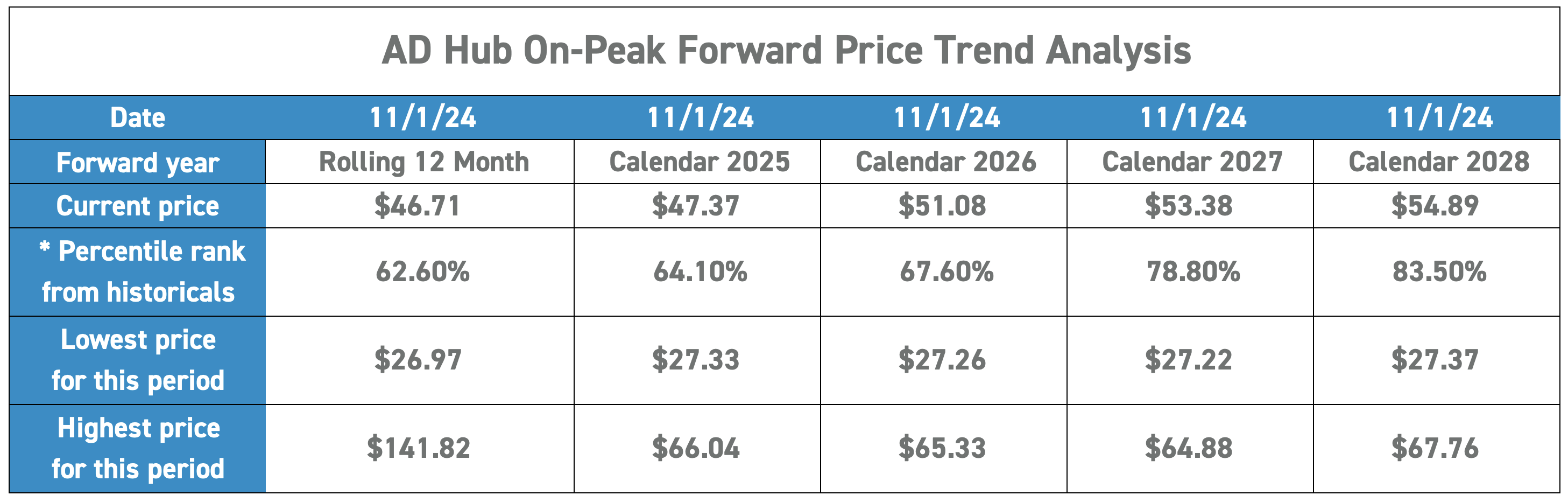

AD Hub On-Peak Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2026, 67.6% indicates that the current price is lower than 32.4% of historical pricing dating back to July 2017.

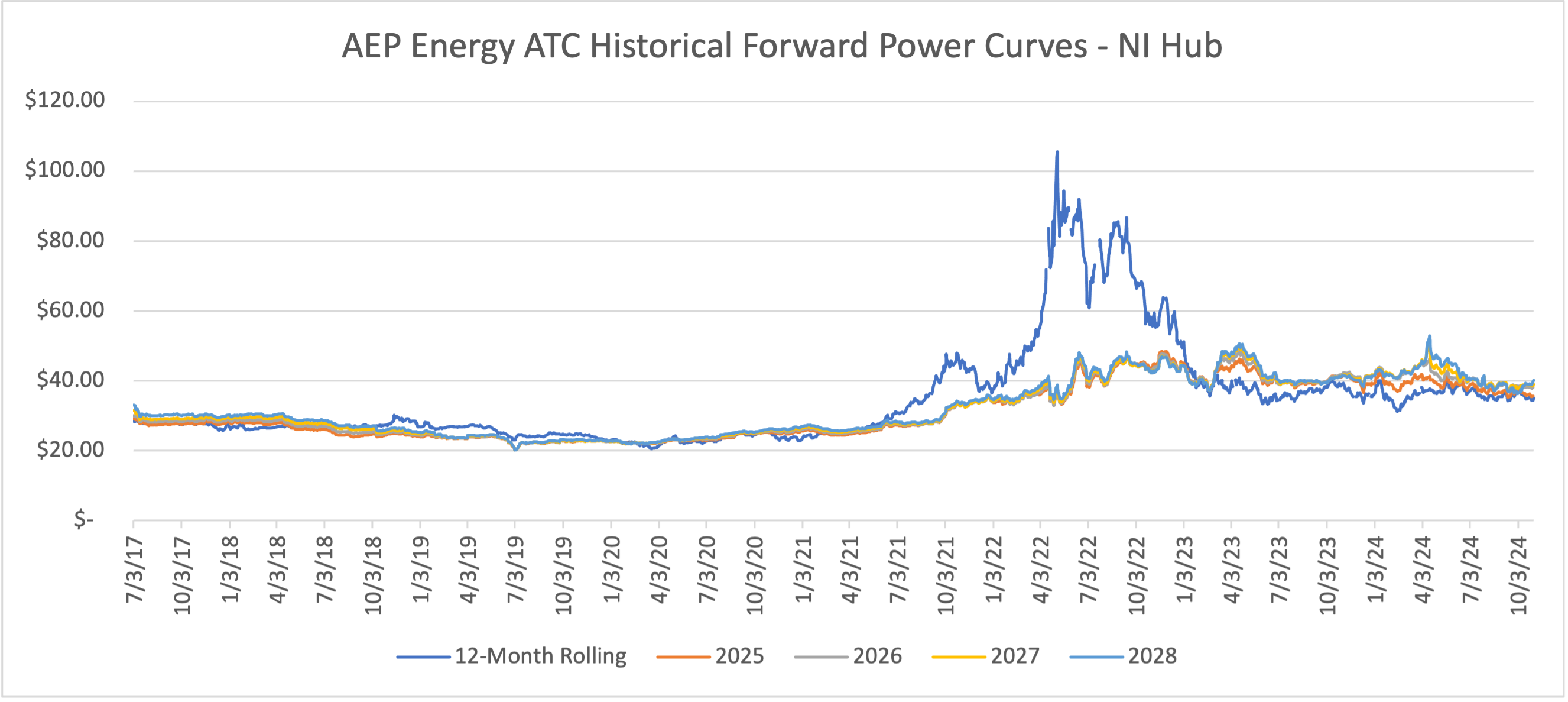

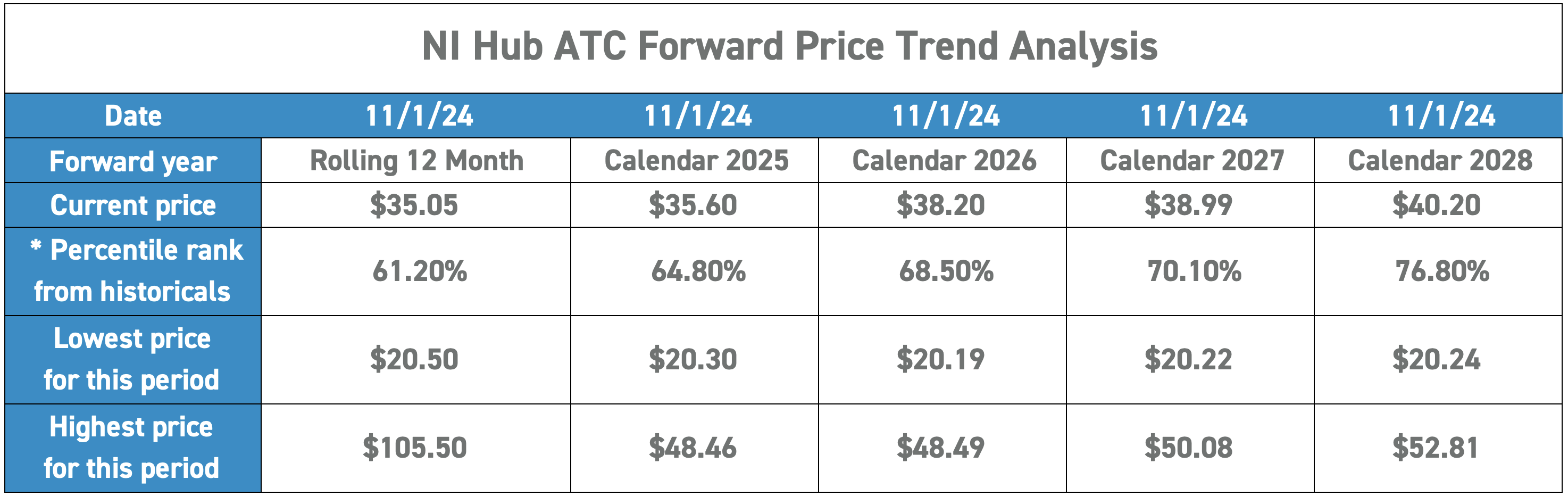

Northern Illinois (NI) Hub Around-the-Clock (ATC)

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. NI Hub priced in Eastern Standard Time (EST)

NI Hub ATC Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2026, 68.5% indicates that the current price is lower than 31.5% of historical pricing dating back to July 2017.

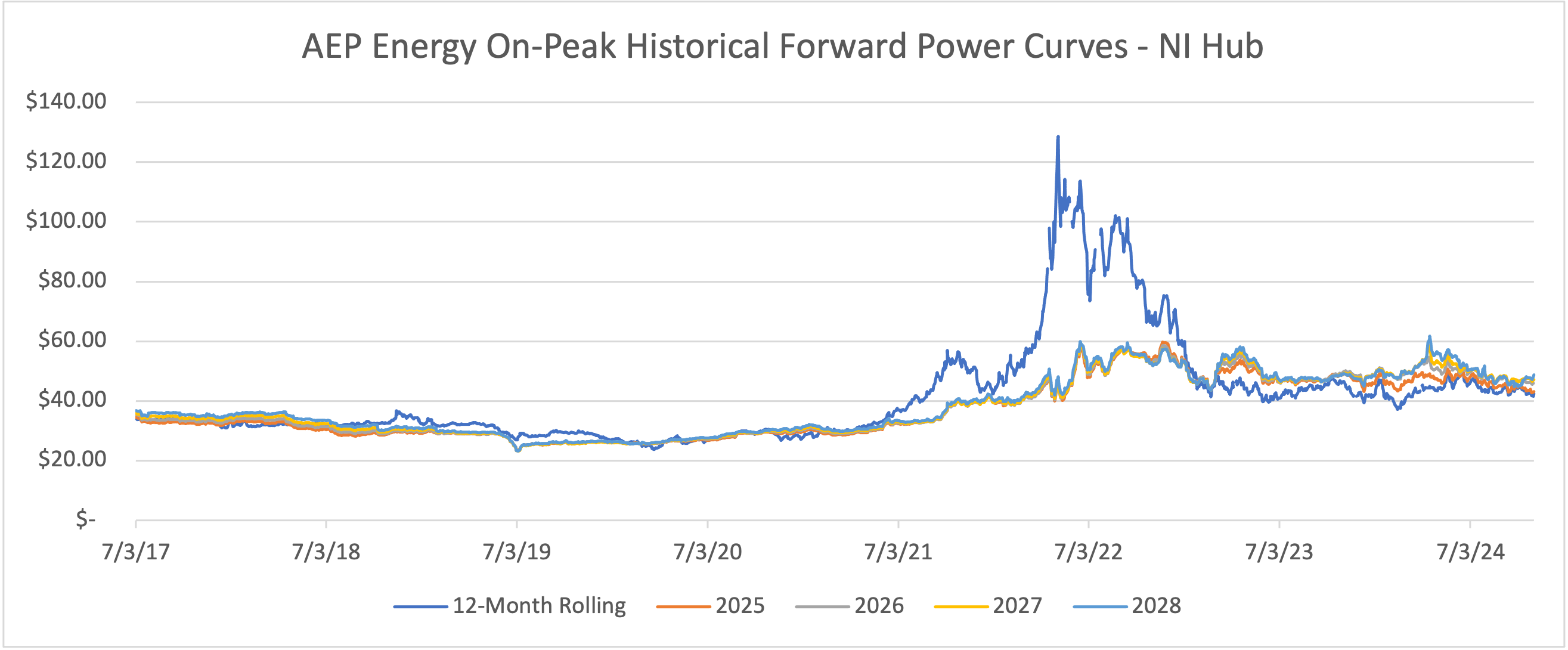

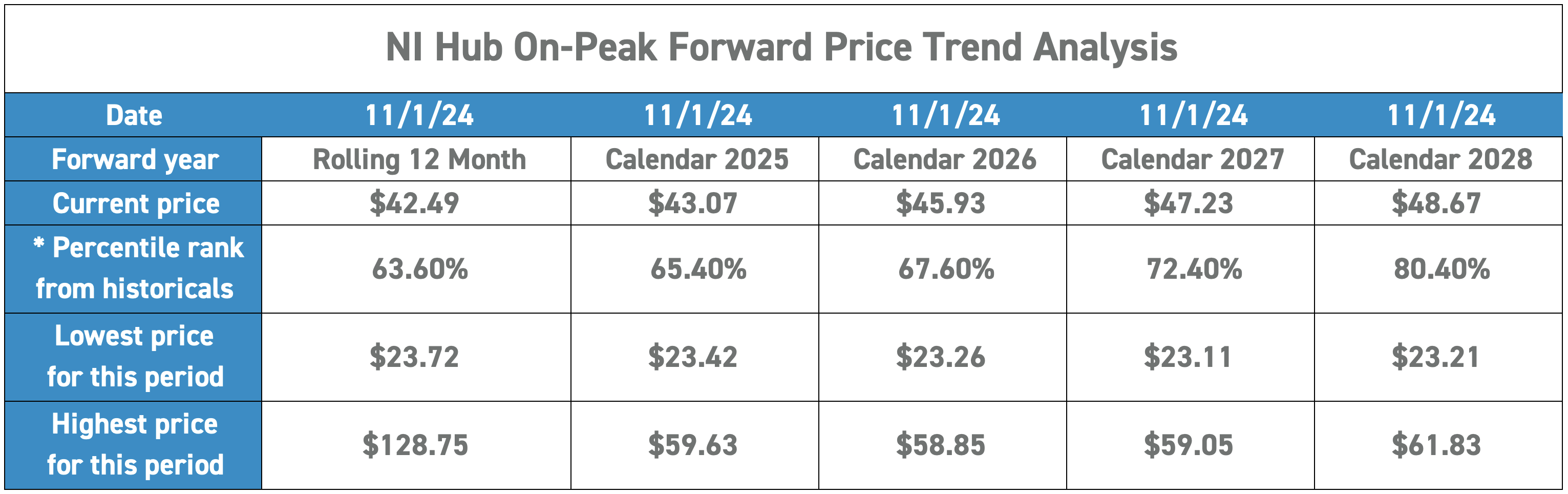

Northern Illinois (NI) Hub On-Peak

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. NI Hub priced in Eastern Standard Time (EST)

NI Hub On-Peak Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2026, 67.6% indicates that the current price is lower than 32.4% of historical pricing dating back to July 2017.

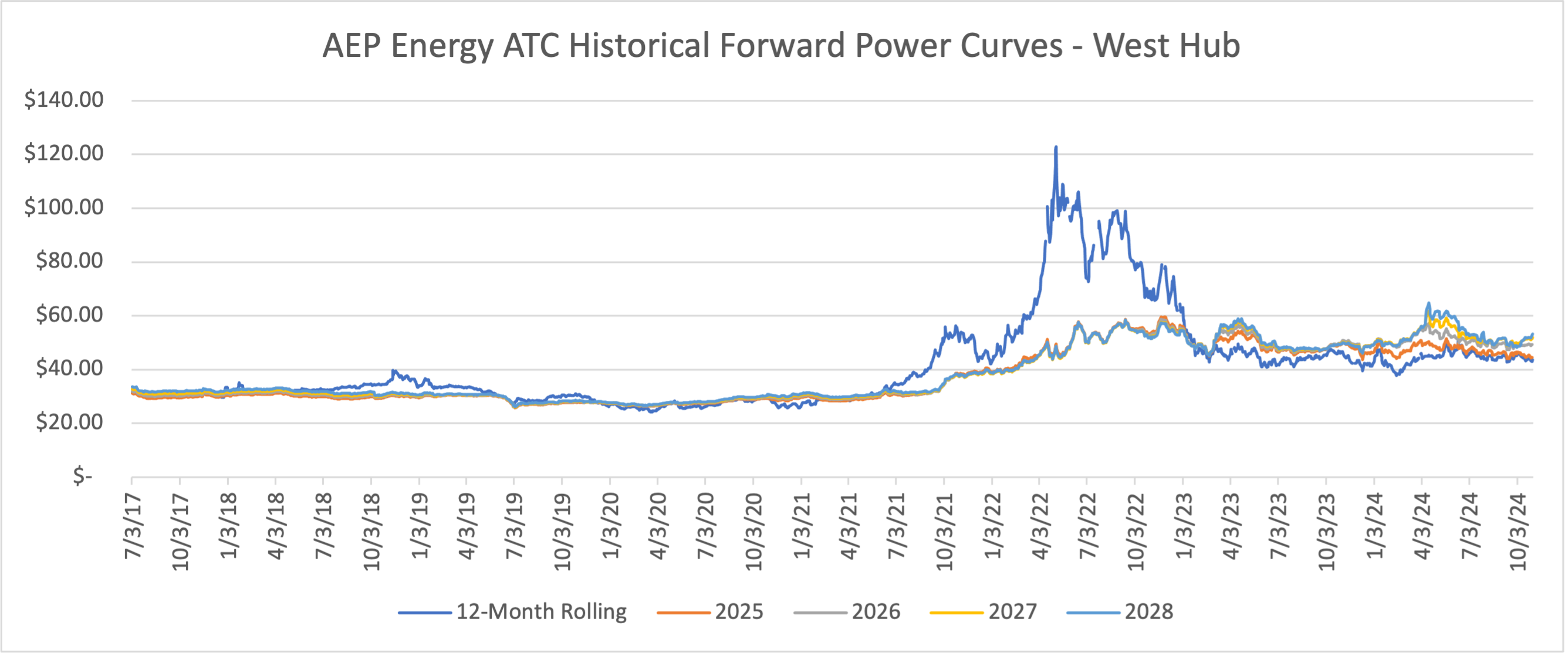

Western (West) Hub Around-the-Clock (ATC)

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. West Hub priced in Eastern Standard Time (EST)

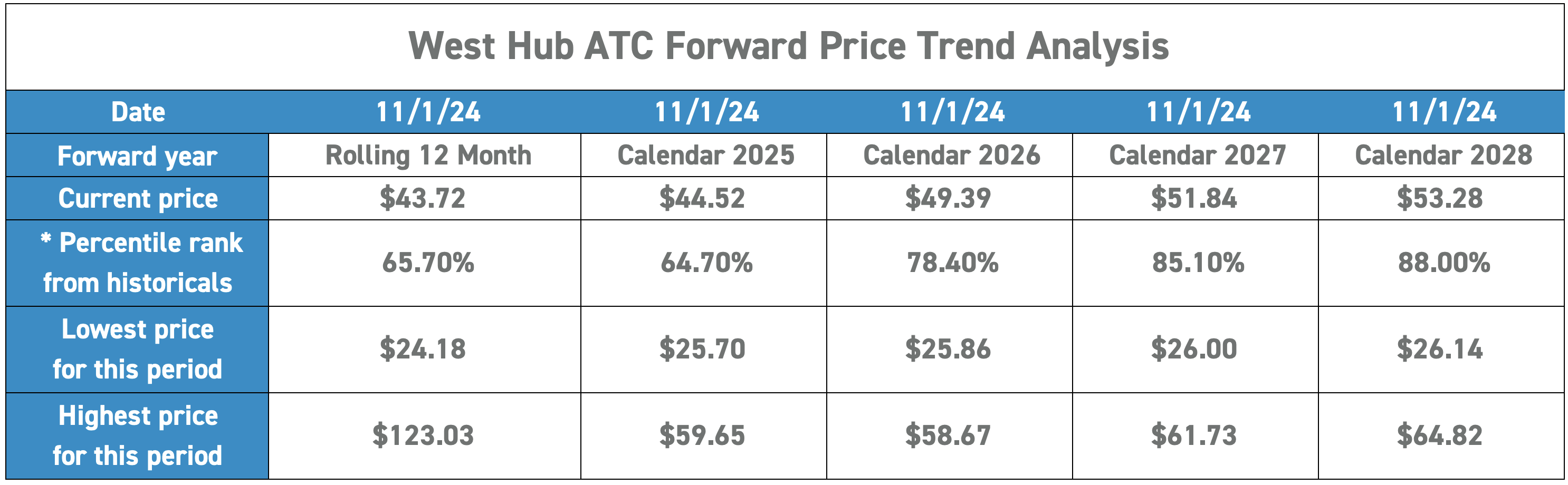

West Hub ATC Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2025, 78.4% indicates that the current price is lower than 21.6% of historical pricing dating back to July 2017.

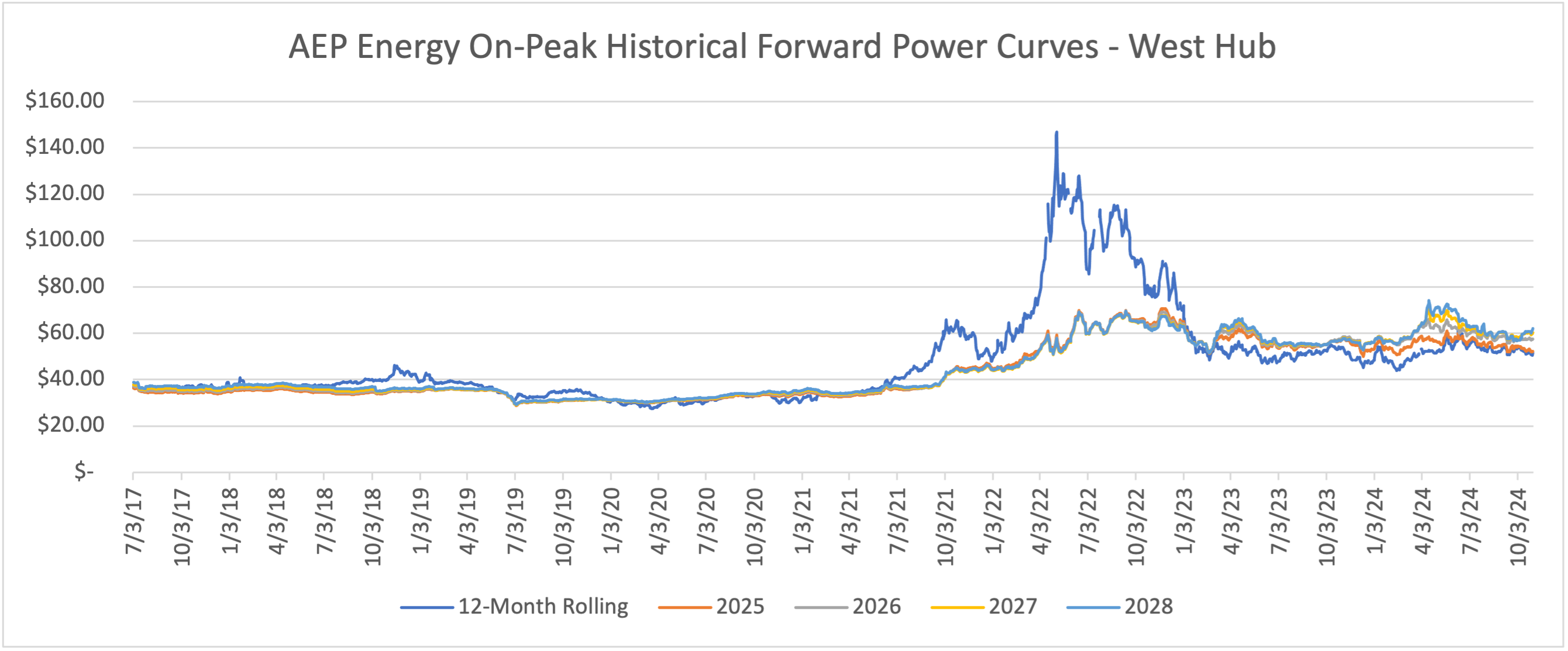

Western (West) Hub On-Peak

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. West Hub priced in Eastern Standard Time (EST)

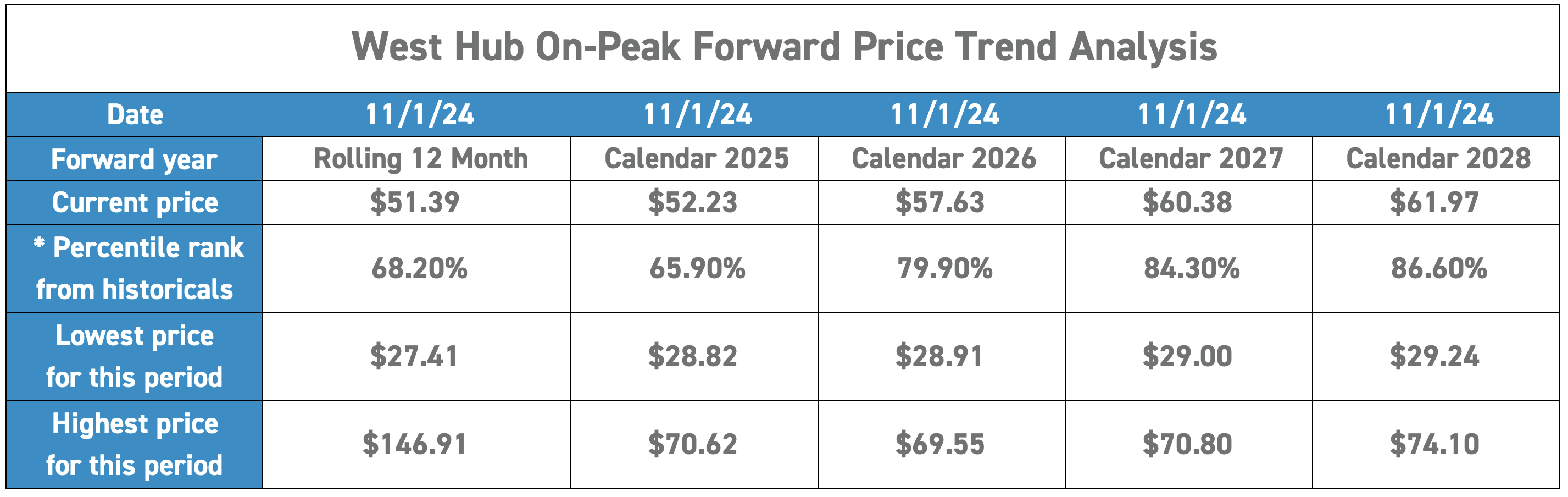

West Hub On-Peak Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2026, 79.9% indicates that the current price is lower than 20.1% of historical pricing dating back to July 2017.

Weather

Source: AEP Energy Supply Meteorologist

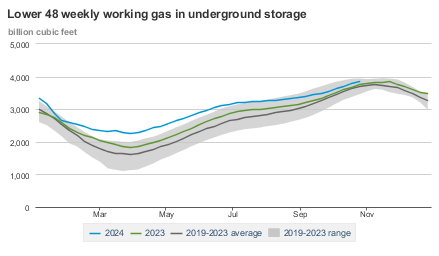

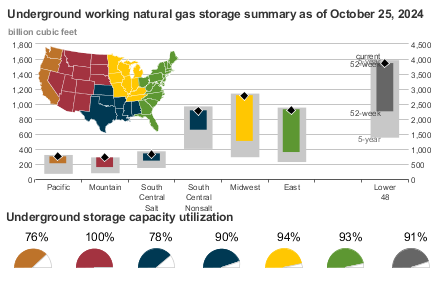

Natural Gas Storage

Source: U.S. Energy Information Administration (EIA)

EIA Natural Gas Storage

Working gas in storage was 3,863 Bcf as of Friday, October 25, 2024, according to EIA estimates. This represents a net increase of 78 Bcf from the previous week. Stocks were 107 Bcf higher than last year at this time and 178 Bcf above the five-year average of 3,685 Bcf. At 3,863 Bcf, total working gas is within the five-year historical range.

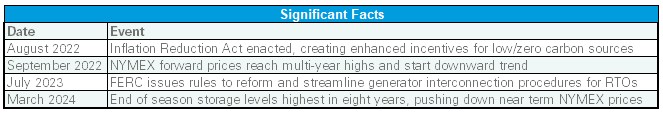

Significant Facts

AEP Energy does not guarantee the accuracy, timeliness, suitability, completeness, freedom from error, or value of any information herein. The information presented is provided “as is”, “as available”, and for informational purposes only, speaks only to events or circumstances on or before the date it is presented, and should not be construed as advice, a recommendation, or a guarantee of future results. AEP Energy disclaims any and all liabilities and warranties related hereto, including any obligation to update or correct the information herein. Summaries and website links included herein (collectively, “Links”) are not under AEP Energy’s control and are provided for reference only and not for commercial purposes. AEP Energy does not endorse or approve of the Links or related information and does not provide any warranty of any kind or nature related thereto. Forward-looking statements contained herein are based on forecasted or outlook information (including assumptions and estimations) but any such statements may be influenced by innumerable factors that could cause actual outcomes and results to be materially different from those anticipated. As such, these statements are subject to risks, uncertainties, fluctuating market conditions, and other factors that may cause actual results to differ materially from expectations and should not be relied upon. Whether or how the customer utilizes any such information is entirely its responsibility (for which it assumes the entire risk).